Joint Venture

Investments in joint ventures are aimed at capacity building for small and medium sized developers to provide affordable housing on a mass scale. The key issues in the consideration of a joint venture are the availability of land, amalgamation of title deeds and a fully worked out master plan.

In amalgamation of title deeds, a completely new entity is formed to house the combined assets and liabilities economics. Under operating economies, amalgamated members title deeds optimally utilizes members land and also manages to reduce housing development operating cost, management cost, and personnel cost.

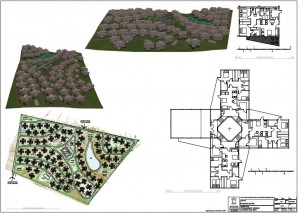

A fully worked out master plan established housing estate with society’s owned civic amenities and infrastructure such as schools, business premises, supermarket, recreation and entertainment facilities, commercial offices, health clinic, green spaces, a house of worship, petrol station and a restaurant. It also established four spacious luxurious 3-bed roomed apartments for each member. The apartment units included a large living room, large bedrooms, a separate dining area, a modern kitchen, a laundry and drying area and a spacious study area.

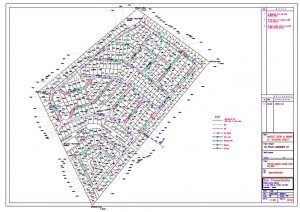

The proposed estate was designed to allow phased development permitting rapid growth whilst ensuring that the society’s owned civic amenities and infrastructure grow with the population’s needs. The process of amalgamating of 400 duly registered title deeds faced many challenges and it therefore failed the test.

Click on any of the below images to view in full size

Site Plan Site Plan |

Master Plan Master Plan |

Appartments Appartments |